THE BACK TAX STRATEGY GUIDE.

Most of this blog post comes from the book Unf*ck Your Biz.

TO WHOM THIS POST APPLIES

The U.S. Tax Code, along with its regulations, covers about 16,000 pages. If we add in IRS publications, revenue rulings, manuals, and other publications, it’s about 100,000 pages. If we add in court rulings, it’s a totally bananas multiple of that. Woah. Layer on top of that the web of bureaucracy, and it’s understandable why most taxpayers feel totally ill equipped to deal with the IRS. But good news, friend. The vast majority of that reading is unnecessary to represent yourself in front of the IRS. Instead, my goal is to give you the broad overview. You learn how the IRS operates and how to navigate their systems.

To do that, we need to first check in on your current tax situation. How are you doing? Put yourself in one of the following categories:

I’m absolutely crushing it.

I’m doing pretty okay. I’m paying quarterly taxes and keeping my books up to date, but my systems could likely be improved.

I’m not paying quarterly taxes, but I have filed on time each year and don’t owe any back taxes.

My tax filings are up to date, and I’m already on a payment plan for back taxes.

My tax filings are up to date, I owe back taxes, and I currently don’t have a solid plan for them.

I’m behind on my tax filings.

This post is for those who fall into #5 or #6 above, or maybe #4, where you’re not quite sure if you’re doing things in an ideal way to get caught up.

If you’re a year or more behind on filing or paying your taxes, there may be some options for you. It's time to rip the bandage, roll up our sleeves, and get to work.

WHY YOU GOTTA GET CAUGHT UP ON FILING

Pop quiz. Which do you think is higher: the penalty for paying taxes late or the penalty for filing taxes late?

The penalty for filing your return late is much higher than failing to pay the taxes on time. It’s 5% versus 0.05% of the tax owed per month. Therefore, your top priority should always be filing timely (or getting caught up on filings). Repeat after me: Braden, I promise to always file my taxes on time.

Even if you know you won’t have the money to pay the taxes, you should always timely file. After that, you can work on payment options. Note that you also won’t know how much you owe or what settlement or payment plan options you have until all your returns are filed. Filing is always priority number one.

If you are behind on filing, prioritize catching up, whether you’ll do that on your own or by hiring a professional. Either way, you also need to start and/or finish your bookkeeping for the years in which you need to file. That’s why we started with bookkeeping in Part 1. If you do need to file back taxes, I recommend reading through this book once to get the big picture. Then, circle back to this chapter to implement the action steps.

We can also assist with current and past due taxes, as well as IRS payments and settlement options, in the law firm. This chapter can let you know what some options might be, but you can always go through our website, www.notavglaw.com, to work with us directly.

THE ROADMAP

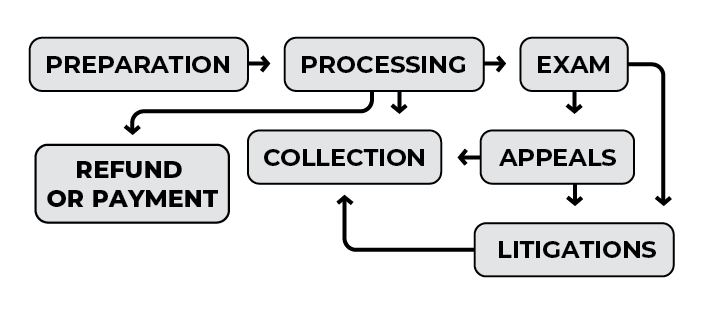

I mentioned back in the Intro that I’m a big-picture person. I like to see the full process before I dive into details. Lucky for us, the IRS has put together an awesome resource, which you can find at https://www.taxpayeradvocate.irs.gov/get-help/roadmap/. When I first found this roadmap, I shared a screenshot on my Instagram stories and joked that someone at the IRS thought, Our taxes are super complicated. This should clear things up. . . .

But all jokes aside, their roadmap is quite handy. If you go to the URL, you can see how dynamic it is. You can zoom into each area. Most of the steps are also clickable, so they expand with more detailed info. If you have back-tax issues, I encourage you to do that at some point. Meanwhile, let’s operate from my stripped-down version.

This does a better job explaining the basic process. Let’s talk through it.

The tax process starts with our tax return. Assuming we file, the return goes to processing. If you had a tax balance due and you paid that balance, you’re at the end of the road if there are no issues in processing. “No issues” means the IRS has determined your return was correct. You also reach the end of the road if you have no issues and are due a refund. The IRS issues that refund, and you’re out of this whole system.

If there is an issue with your return, it will go to examination. If there are no immediate examinable issues, you do have a balance, and you haven’t paid your balance, you will go to collection.

Makes sense, right? If they’re like, “Hey, you owe us money,” to collections you go. If they’re like, “Hey, your return says one thing, but we actually think it should be a different thing,” then they need to investigate and you go to examination. Examination is the broad area where audits happen.

It’s also possible you could be sent to collections, but then you’re like, “Hold up. I don’t actually owe you that.” In that case, you could be re-routed to examination, or appeals, or it can be handled within the collections area. This is actually your most likely scenario. That’s good. It means you can argue with the IRS about stuff without them sending you into a full-blown audit.

If you failed to report a 1099, you could be sent straight to collections. This is super common. Basically, the IRS doesn’t need to examine anything. They just believe you didn’t report something. No examination is necessary.

If your return does go to examination, it could end there or not. There are three types of audits in the examination section. We discuss those later. You can win your audit. Yay! That’s then probably the end of the line. The alternative is a loss or partial loss, in which case you can accept the result and pay (or go to collection if you don’t pay).

If you don’t accept the result, you can appeal. It’s in the IRS’s discretion as to whether they accept your appeal. That’s why there’s an arrow that also goes straight over the appeal. If you appeal and disagree with the appeal, you can file a tax court case and go in front of a tax judge to argue against the IRS. You can also go straight to tax court and skip the appeal if they don’t grant you an appeal.

Once you reach a resolution in the appeal or at tax court, you will pay the balance, if you owe one, or be filtered back to collection.

This is why the IRS Roadmap looks like such a mess. Collection is in the middle, and you end up there any time you have an unpaid tax balance with the IRS.

Now, that’s the brief explanation of the roadmap. I hope it makes more sense. With this context in mind, take a look back at my roadmap. Is it more clear? If yes, the IRS Roadmap should also be more clear if/when you need to reference it.

Now, we discuss the key stations in this roadmap. (I like to call them stations because the map looks like a metro map.)

In my book, I go through more each of these areas in turn, processing, examination, appeals, litigation. We’re skipping over those here and going straight to collections.

We’ve got more posts

If this back tax blog post applies to you, you 100% need to read our general post…

The Ultimate Tax Guide for Creative Small Business Owners,

And, our Tax Deduction Post would be a great idea too.

WANT UPDATES ON TAX DEADLINES?

Not everyone can have a lawyer and tax pro in their back pocket. Although we make that pretty doable with our monthly service.

We offer peace of mind in our monthly Newsletter where we send monthly legal updates, tax deadlines, and helpful guides and checklists when helpful.

GET UPDATES -

GET UPDATES -

TAX COLLECTIONS

There are a few ways you end up in collection:

You owe but don’t pay when you file.

The IRS makes a swift assessment (probably through the IRT program).

You end up owing through the examination process, which takes place after an appeal or tax court.

This is why you see collection in the middle of the complex IRS Roadmap. You can go there quickly or after a long, back-and-forth process.

And much like the other areas of the IRS, collection has its own lengthy process, but in this case that’s good news for us. They typically give ample opportunity to settle a balance before going after your assets. Here’s an overview of their general process.

Computer generated notices →

IRS Automated Collection System (ACS) →

Assigned revenue officer from the collection division →

(May) Assign debt to a private agency

For the first several months you’re in collection, you will likely only receive computer-generated notices. Once you get contacted by ACS, it means humans are looking at your files and contacting you.

The IRS relies heavily on computer-generated notices to reduce the workload of its understaffed offices. The notices are called Computer Paragraphs, or CPs. If your letter starts with CP, it means it was made by a computer, not a human.

Most taxpayers get the following CPs in the following order:

CP-14, You Have Unpaid Taxes

CP-501, You Have a Balance Due

CP-503, Immediate Action Is Required

CP-504, You Have an Amount Due—Intent to Levy

It may take up to six to 12 months to receive this full sequence, but that process may speed up and you may skip some letters for more serious tax issues.

The next letter is CP-90, Final Notice—Intent to Levy and Notice of Your Right to a Hearing. This means you’re being passed off to the next stage in the IRS, which is when things start to get real and should be met with immediate action.

The follow-up is Letter 508, Final Notice, Notice of Intent to Levy and Notice of Your Right to Hearing. Please Respond Immediately. Failure to respond within 30 days may result in levies on your bank accounts or notices to others to garnish wages. They may also issue CP-49, Overpaid Tax Applied to Other Taxes You Owe, which simply means they will start to apply other tax refunds toward your balance.

After all these letters, you go to ACS. The IRS will leverage its authority to collect from you through various ways like bank levies and property liens. If needed—like if you didn’t start reading this book until after you already received all your CPs—you can ask for a temporary freeze hold, which lasts up to 45 days.

Or, if you have few assets and little income, you can file a form 433-F, Collection Information Statement, to request “currently non-collectible” (CNC) status or a “significant hardship case” status. This puts a freeze on IRS collections for 12 or more months. You’d only go this route if you can’t pay with one of the options we’re about to discuss.

To delay the collection process, you can also respond to each bill and ask for 45 more days to pay. That’s the max amount they can give you.

WHAT IF YOU NEVER FILED?

If you never filed your tax return, the IRS can demand you do so with huge penalties. They can also do a “substitute for return” (or SFR). These are super common.

Let’s say you were issued a W-2 and 1099 and never filed a return. The IRS can create a generated return for you. They will claim your income and standard deduction but likely no other tax deductions or benefits, likely resulting in a higher tax balance than you would have had if you’d self-filed. They will then send you a proposed assessment to sign off on and agree to the balance due.

If you don’t agree, you can contest a SFR. Typically, you will need to file an amended return to do so.

Failure to respond to the SFR will result in a Notice of Deficiency. That’s your 90-day letter, which you can contest by filing a tax court case within 90 days.

A NOTE ON TRANSCRIPTS

If you get an SFR and need to create your own return, or if you’re ever missing tax documents for whatever reason, you can get key information at https://www.irs.gov/individuals/get-transcript. Order wage and income transcripts to get a full record of what 1099s, W-2s, and other tax documents the IRS has on file for you. This is super important because, if you’re going back to, let’s say, do tax returns for the last three years, well you better—at minimum—be reporting the income the IRS already has on file for you.

PAYMENT OPTIONS

Let’s rewind now and go back to having a balance owed after you file, before you get sent into the collection process. If you unquestionably owe a tax bill, there are six ways to handle it. “Unquestionably” means you’ve exhausted the examination, appeal, and litigation route, or if you owe when you file and you know you owe without question. If there are questions, or issues, you can always amend your tax returns if you missed something. You should also make sure your balance has been credited properly with payments already made. Here are my six ways:

Simply pay in full. Write a check or pay online.

Set up a monthly installment agreement with the IRS.

Reduce, eliminate, or pay the debt through bankruptcy. (I won’t be covering this option further. If you think it might be an option for you, consult a bankruptcy attorney). That’s serious stuff.

Obtain currently non-collectible status (discussed above) and revisit these options later.

Reduce the debt through an offer in compromise (covered in the next section).

Wait for the statute of limitations to expire, in which case the debt will disappear. This is kind of like playing chicken with the IRS, and you should only be tempted to go down this route if you’ve gone pretty far without IRS contact and/or they really have no way to collect from you.

If you have decent income, option 1 may be your only option. Otherwise, other options may be worth exploring.

PAYING IN FULL

After you file, you can wait until you get a bill to pay. This is a good idea if you only need a month or two to gather your funds. Upon receiving your first bill, you can also request an extension of up to 120 days. But, be careful of the “oh shit” cycle. Consider doing an installment agreement to allow yourself to chop the cycle and start saving for current taxes while paying back tax. I talk more about this in the “My Back Tax Philosophy” section later in the chapter.

INSTALLMENT AGREEMENT

This option is available immediately upon filing and receiving your bill/balance, or after you go through all appeals steps.

You can apply for an installment agreement through the IRS website pretty much anytime. You can also apply for it if/when you efile your return or use the paper Form 9465, Installment Agreement Request.

You must be current on tax filings to apply for an installment agreement. If you’re behind for multiple years, you will file all returns first, find your total tax balance, and apply for an installment agreement for the total.

There are a few different types/categories of installment agreements.

FULL-PAY AGREEMENT

A full-pay agreement is required if you can pay your full tax balance within 10 years. There are a couple subtypes.

A “streamlined agreement” is one in which you can/will pay the full balance within 72 months (six years) and in which your balance owed is less than $50,000. Streamlined agreements get their name because they’re approved almost automatically within 30 minutes of the application.

You can apply at: https://www.irs.gov/payments/online-payment-agreement-application.

To qualify, you must not have had any tax owed or installment agreements within the past 10 years. Non-streamlined agreements simply take longer to get approved and may require more back-and-forth.

If you owe less than $10,000 and can pay in installments within 36 months (three years), you can get a “guaranteed agreement.” These are even easier to get as you presumably are guaranteed approval if you meet the conditions.

I’ve come to the conclusion that the only real thing you need to know about these agreements is the payoff time. Let’s say you owe $9,000. With a $250 monthly payment, it’d take three years to pay your balance, putting you on the cusp of the guaranteed versus streamlined agreement. So maybe you decide you can swing $300 a month in order to fully fall into the “guaranteed” range and have the best chance of approval. Otherwise, your agreements will be largely based on your ability to pay. The nuances should only matter if you’re on the cusp.

PARTIAL-PAY INSTALLMENT AGREEMENT

A partial-payment installment agreement allows you to pay less than your full balance within the statute of limitations to collect (10 years). This is only available if you owe $10,000 or more. The IRS may put liens on your property while you have this type of agreement. They may also request that you liquidate assets to resolve some debt.

To apply for a partial pay installment agreement, you need to complete Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals in addition to Form 9465.

Don’t always assume an installment agreement is your best option. Interest and penalties average out to 6–8%. In our programs and with our one-on-one clients, we help folks balance their tax debts with other debts and financial obligations. You have to look at how it works in the big picture.

OFFER IN COMPROMISE (OIC)

An offer in compromise allows you to make an offer to pay less than the total tax you owe in installments. There are income qualifications for this type of relief. If the OIC is accepted, you must meet certain obligations to eventually dissolve the debt, like meeting future filing and payment deadlines.

Have you ever seen or heard ads that say something like “Do you owe the IRS thousands of dollars? We can help you make your tax debts disappear.” These ads often speak for companies in the business of helping taxpayers through the process of applying for an offer in compromise.

When applying for an OIC, it’s helpful to remember that the agent looking at the application works for the federal or state government. As such, that agent is analyzing the best interests of their respective agency. Their goal is to collect as much as they reasonably can. Therefore, in assessing an OIC, the agent will ask whether the amount offered is the most the agency can expect to collect from the taxpayer within a “reasonable time.”

The application is a bit cumbersome. It asks for all potential income sources and expenses, as well as verification of those income sources and expenses. The applicable agency compares income to expenses to determine how much is left over each month to pay past due taxes. The agent also looks at potential, future sources of income and future expenses. Significant assets may also bar a taxpayer’s likelihood of success. The tax agency’s reasoning is that a taxpayer can liquidate assets like 401(k)s to pay tax debts. Thus, a taxpayer is a good candidate for an OIC when they own few assets and have low income compared to expenses. But don’t let that discourage you. It’s always worth a shot.

There are still a couple more hurdles to qualify. A taxpayer must be up to date with all tax returns before applying. The totality of debts may only be determined after all tax returns are current. The agent will also consider any potential upswings in the taxpayer’s income.

After submitting an OIC with the IRS, the taxpayer must remain in compliance with all provisions of the tax code for five years. This means filing returns on time and paying any taxes owed. Otherwise, the taxpayer’s offer will be negated and the debt will revert back to the pre-offer amount.

During and after my tax program, I volunteered at our local Low Income Taxpayer Clinic. The clinic provides pro bono representation for all types of issues. I talked to individuals who made millions, owed millions in taxes, and lost it all in the 2008 recession. I spoke with low-income individuals who’d won healthy sums of money in casinos. They never paid the tax and the IRS came knocking. And sadly, I talked to a lot of taxpayers who had hired shady tax preparers.

The preparers would run various types of schemes. Sometimes it’d take a couple years for the letters to roll in from the IRS. (Quick tip: Always get a referral for tax return prep, or just hire us. We don’t do schemes. I promise. And never hire someone who promises a certain amount you will be refunded.)

While working at the clinic, OICs were far and away the most common task we’d work on. My boss, who ran the clinic, had it down to a science, and could tell you what offer you could give and how long it’d take to accept.

It was also quite common for clients to come in several years behind on tax filings. First, we would get the returns up to date. Then, we could determine the total tax owed and proceed with the OIC.

If you have outstanding tax liabilities and meet the criteria in this section, contact a tax lawyer to discuss options. An OIC may be a great option.

HOW TO FILE AN OIC

Google “IRS Form 656.” Locate and download the form. Then, search for the “IRS Form 656 instructions." Follow the instructions, fill out the form, and send it in according to the instructions.

There’s a typical application fee of about $180. Individuals can qualify for a low-income exemption from the fee if AGI falls below 250% of the federal poverty guidelines, which is $31,255 for a household of one in 2019.

CURRENTLY NON-COLLECTIBLE

If you’re in financial hardship, you can request to go on “currently non-collectible” status. This is an option to look into when you’re receiving communication from the IRS that they plan to levy your bank account. It’s a temporary fix to pause their collection efforts against you while you either get back on your feet or plan your back tax strategy.

WANT UPDATES ON TAX DEADLINES?

Not everyone can have a lawyer and tax pro in their back pocket. Although we make that pretty doable with our monthly service.

We offer peace of mind in our monthly Newsletter where we send monthly legal updates, tax deadlines, and helpful guides and checklists when helpful.

GET UPDATES -

GET UPDATES -

MY BACK TAX PHILOSOPHY

You now know some of the common options for getting caught up on taxes. In this section, I share a few tips on how to develop a catch-up strategy. I’m assuming you won’t be able to pay the debt in one lump sum. If you can, great! Do that. If not, you need a plan to pay on an installment agreement. When it comes to developing a strategy, I generally recommend one of two options.

Think about how much cash you can reasonably put toward your tax debt each month. Also, consider whether you plan to seek any special circumstances like the OIC. If so, you won't want to get on a payment plan until after that is done. Decide whether you want to work with a professional and/or apply for an OIC or similar relief. That's your first step.

Your second step is to get set up with an installment agreement to pay down any remaining balance owed. That's what we'll focus on here.

Quick tip: Many cities have low-income taxpayer clinics. These clinics can help you with filing back taxes and even applying for OICs to resolve debts. If you think you may qualify, search for a clinic in your area.

Many business owners begin working on back taxes without also planning and saving for the current year quarterly taxes. (It’s difficult to take care of both. I totally get it.) But what happens if you're only focused on the back tax? You're basically always one year behind. So by the end of this year, you may have last year covered, but when you file taxes again, you're still behind because you weren't paying quarterlies for the current year. I call this the “oh shit” cycle. It’s reassuringly common, but no one really talks about it. So how do we fix this? One of two ways.

The first option is to aggressively pay down the back tax first by putting all discretionary funds toward the tax debt before turning to quarterlies. The second option is to focus on saving for quarterly taxes now while paying off the back tax incrementally with doable monthly payments. Also consider that this is not a text on personal finance. Independently consider these options within the broader context of your savings, bills, and any other debt you may have.

OPTION 1

Go with an aggressive plan to pay down back tax first and move to quarterly taxes. Figure out the maximum amount you can reasonably pay each month. Consider whether you can at least pay more than the amount you already should be saving for quarterly taxes.

For example, you may have determined in Part 2 that you must save 15% of your gross income for quarterly taxes. Maybe you take a look at your budget and decide you can afford to set aside 22% of all income to pay toward taxes.

With option 1, you set aside 22% of all your income and make monthly tax payments toward your tax debt until it's fully paid. You continue to save 22% until you're caught up on the amount you should have set aside for quarterly taxes.

This option works well if you can pay off both the past debt and get caught up on current taxes within the span of oneyear. If that's not feasible, look toward option 2.

OPTION 2

Start at the same point. Figure the maximum amount you can contribute each month toward taxes. Let’s use the same 22% figure. If you have a larger tax debt, paying the full debt while saving for taxes may be a struggle.

Instead, focus on saving for current quarterly taxes to stop the “oh shit” cycle. Then, pay whatever is left toward monthly payments on the back tax.

For example, assume you owe $10,000 in taxes. You gross about $80,000 a year. Your quarterly tax savings percentage is 17%. Thus $13,600 needs to be set aside for taxes. You determine that, at most, you can pay $1,500 toward taxes each month. $1,134 is what will be set aside for quarterly taxes ($13,600/12). Thus, you pay about $360 each month toward back taxes.

If you continue to make those monthly back tax payments, you’ll have the back tax paid off in twenty-eight months (two years and four months). Happy news? Probably not, but if you tackle it with that plan in mind, you can look forward to no longer being behind on your taxes. You’re cutting off the “oh shit” cycle by placing a focus on current taxes in addition to the debt.

So how do you know which option will work best for you? You gotta do the math.

TIPS ON FILING BACK TAXES

Have you received any letters from the IRS about amounts that you owe? Don't take them for 100% certainty. When you fail to file a tax return, the IRS will do their best to estimate how much you might owe based on the information they have. However, they never have the complete picture. They pretty much always overestimate. It’s your responsibility to actually complete a tax return for that year to find the actual amount you really owe and pay it.

Here are some quick tips to help you with filing:

Start with the first year you need to file. For example, if you haven't filed for years 2018, 2019, 2020, and 2021, do the 2018 return first with a program like TurboTax or H&R Block Online. That way, when you go to do 2019, it can start by importing your info from the prior year return, saving you time.

If you’re totally overwhelmed, consider working with a professional tax accountant—but don't try to find a discount. Remember: We’re trying to unfuck your taxes, so be careful whom you trust to fix the issues. You don’t want to work with one of those shady people I mentioned earlier.

BACK TAXES ARE MORE COMMON THAN YOU THINK

The IRS estimates about 15% of all taxpayers owe some back taxes, yet, based on discussions I have had, I know that most business owners who have back taxes feel alone. It makes sense. We don’t usually talk about our late bills, unfiled tax returns, and parking ticket collections at dinner parties. Whenever I review new member surveys, I expect about 25% of the new students in my program to have some form of back taxes.

What’s become an expectation for me is always a surprise and a relief to the students. It’s the first time they typically feel like they can openly discuss their back tax. In one round of the program, several students were multiple years behind on filing their taxes. One of those students was Amanda, owner of Sassy Little Bee, a wedding planning company.

Amanda was in the program in spring 2020. She still hadn’t filed taxes for 2016, 2017, 2018, and 2019. She shared she never felt like she had enough money to hire pros but was overwhelmed when considering DIY-ing the back tax.

I’m a big believer in steps. When I’ve run IRONMAN triathlons, I don’t start the swim thinking about mile 20 of the run. When I sat down to write this book, I focused on the first step I needed to take. The first step to any big project is finding the starting line.

For Amanda, the starting line was filing the tax return for 2016. Before getting there, she needed to wrap up her bookkeeping for the year, which had largely been done in Quickbooks. She could file that return and methodically continue through each year. As Amanda put it, “I finally just decided to grab some snacks and caffeine and make it happen.”

While she was working through her returns, she also had her tax savings on autopilot. Her goal was to cut off that “oh shit” cycle. After completing the returns, she had a total dollar amount for her back tax. She was relieved to see it was quite a bit lower than what she’d expected.

From there, Amanda could begin to pay down the debt. Amanda is now in the process of filing an OIC. Provided her offer gets accepted, she’ll make monthly payments until the offer is fully paid all while saving for, paying, and filing current taxes.

Is that all easy breezy? No, of course not. I’m not going to bullshit you and tell you to block a half an hour on your calendar for all that. But it is doable. It mustn't be beyond overwhelming. Find your starting line. Create an action plan. Put it on your calendar. Do the work, and see the results. Remember: You’re the CEO of your business. You must prioritize unfucking your taxes.

I WROTE A WHOLE-ASS BOOK, AND

I never thought people would be jazzed about reading a book on law in tax, but the reviews are in! And most read something like "I read this whole book, and I didn't hate it, and now I know stuff.

But for real, it walks you through my full "Unf*ck Your Biz Framework" - something I created for my first course, which was $2,000 and saw over 70 graduates - and is like the A to Z guide to get you started.

UNF*CK YOUR BIZ, THE BOOK -

UNF*CK YOUR BIZ, THE BOOK -

“I never thought I would say I enjoyed reading a book on taxes, but I definitely did. Braden’s wit and spunk made this, often times, traumatic topic of taxes, actually really fun and enjoyable. He put into perspective the proper ways of filing your taxes, as well as covering if you should become an LLC, S Corp or sole proprietor, for small business owners. It was jam packed with knowledge and key tips that I have already put into effect in my own business! I’m so thankful that Braden has decided to share his knowledge and help us small business owners. Highly, highly recommend reading this book and getting your legal stuff figured out!”

- Kelsey, Owner of Kelsey Rae Designs